Take care of your finances — virtually anytime, any place.

![]()

![]()

![]()

![]()

![]()

![]()

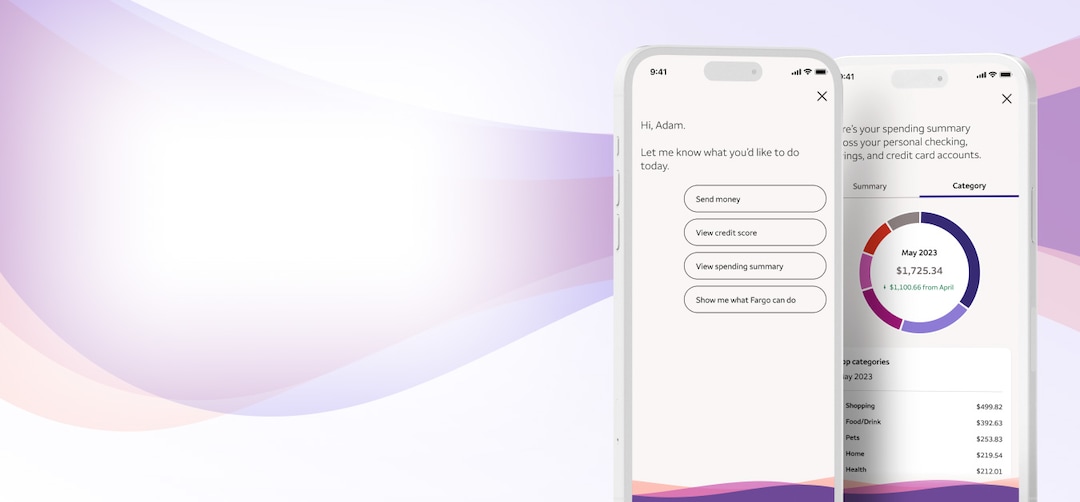

What’s my account balance? How do I find a recent transaction? What’s my routing number?

Fargo , your new virtual assistant in the mobile app, gives you shortcuts and quick answers to your everyday banking questions.

Manage your money on the Wells Fargo Mobile ® app when you’re on the go. And use Wells Fargo Online ® when it’s more convenient to be on your computer.

How was your experience? Give us feedback.

Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Fargo is only available on the smartphone versions of the Wells Fargo Mobile ® app.

Mobile deposit is only available through the Wells Fargo Mobile ® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

Subject to account eligibility requirements. Advances from linked credit accounts accrue interest from the date of each advance. Advances from credit cards accrue interest at the cash advance rate. Please see your credit agreement for more details.

Terms and conditions apply. Some (but not all) digital wallets require your device to be NFC (Near Field Communication) enabled and to have the separate wallet app available. Your mobile carrier’s message and data rates may apply.

Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier's message and data rates may apply.

Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Online Statements require Adobe ® Acrobat ® PDF reader. The length of time Online Statements are available to view and download varies depending on the product: up to 12 months for auto loans; up to 2 years for credit cards, home equity lines of credit, and personal loans and lines of credit; and up to 7 years for deposit accounts, home mortgage accounts, and trust and managed investment accounts. The length of time the specific product statements are available online can be found in Wells Fargo Online ® in Statements & documents. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier’s message and data rates may apply.

Quicken is offered by Quicken, Inc. Wells Fargo doesn't own or operate Quicken. Quicken is solely responsible for its content, product offerings, privacy, and security. Please refer to Quicken's terms of use and privacy policy, which are located on Quicken's website and are administered by Quicken.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

QuickBooks and Quicken are trademarks of Intuit Inc. registered in the United States and other countries.

Wells Fargo Bank, N.A. Member FDIC.